Financial advisors should also consider the impact of state income taxes (especially if the client is planning to relocate to a different state in the future), and charitable contributions, as well as the step-up in basis of inherited assets received by beneficiaries, and even the beneficiaries’ own tax rates. These include the taxation of Social Security benefits, which phases in as income levels rise (such that harvesting income can actually trigger taxation of these benefits) Medicare Part B and Part D Premium Surcharges, which increase with higher income levels and the Net Investment Income Tax (NIIT), which increases part of the 15% and the entire 20% capital gains tax brackets by 3.8% and applies not just to capital gains income but also to interest and dividend income as well (except for IRA withdrawals, including those carried out for Roth conversions, which are not subject to NIIT). However, the changes in ordinary and capital gains tax brackets as income itself rises (if only through the impact of deferring that income in the first place) are not the only factors to consider when deciding whether to harvest income, though, as there are other mitigating factors that will impact a taxpayer’s overall tax liability. In other words, the choice to harvest either ordinary or capital gains income will largely depend on how that additional harvested income will impact future income tax rates (for that particular type of income, given that individual’s own income growth trajectory). However, for clients in the 10% or 12% ordinary tax bracket (but still in the 0% capital gains tax bracket), it’s often better to harvest capital gains income (versus ordinary income) to reduce the impact of future capital gains income taxed at the 15% capital gains rate (and thus minimizing a 15% increase in capital gain taxation from 0%, compared to a 10% increase, from 12% to 22%, in ordinary income tax). For instance, those in the 0% ordinary income tax bracket can benefit more from harvesting additional ordinary income (versus capital gains) at 0%, as the jump to the next ordinary income tax bracket (once income turns from negative to positive) is significant. Because capital gains may be harvested at 0% for those in the bottom two tax brackets… but only if other ordinary income doesn’t ‘crowd out’ those lower tax brackets first!Īccordingly, financial advisors can design optimal income harvesting strategies for their clients by considering when it’s better to harvest ordinary income at its brackets, versus capital gains at those brackets, depending on the relative outlook for each in the future.

#LONG TERM CAPITAL GAINS TAX BRACKETS 2020 HOW TO#

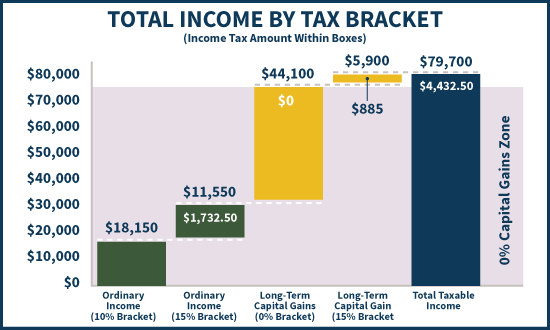

But how does the financial advisor choose the best strategy when it comes to avoiding too much tax deferral and harvesting income instead, especially when there are opportunities to harvest both ordinary income (e.g., Roth conversions) and also capital gains (at their own preferential rates and tax bracket thresholds)?Īdvisors choosing between these methods – and whether to harvest ordinary or capital gains income – should consider the tax rate brackets associated with each income type to assess how to most effectively minimize overall tax liability (both now and in the future), as well as the “Capital Gains Bump Zone” – where the marginal tax rate on ordinary income can be driven substantially higher by indirectly driving capital gains (along with income generated from qualified dividends) into higher capital gains brackets as well. However, in the opposite circumstance, when current taxable income is lower than anticipated future income (e.g., because the client is building substantial wealth), it can be beneficial instead to harvest income instead, take advantage of the taxpayer’s lower tax bracket, and limit the amount of income deferred into the future which would presumably be taxed at a higher rate anyway (as the more income that is deferred to the future, the greater the risk of bumping up the taxpayer into an even higher tax bracket as a result!).

For many high-income clients, financial advisors recommend deferring income as a strategy to mitigate taxes, especially when the client is in a high tax bracket and expects to be in a lower tax bracket in the future as income levels decline (e.g., after retirement).

0 kommentar(er)

0 kommentar(er)